After your car accident, your vehicle may not be ready to drive and may have some major damage. You may be wondering how you’re going to get to work, run errands and live your everyday life without a car.

For most people, one option is to get a rental car. Under your insurance policy, you may have already purchased the ability to rent a car in case of an accident. This is pretty typical. But you may also be able to do this by charging it to the other driver’s insurance company if you don’t have this coverage yourself.

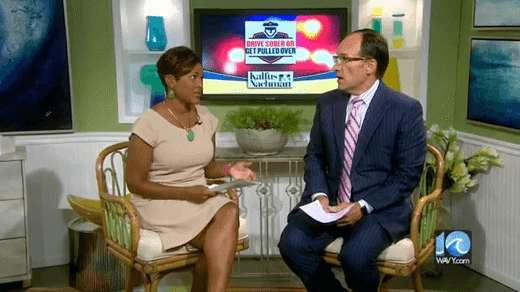

When you go to rent a car by using your insurance policy, you should be getting a rental that is in like kind of your own type of vehicle. What this means is that you will be renting something very comparable to your own vehicle. They have to fulfill your needs whether you use the car for personal and/or business use. You will be able to use this rental vehicle until they complete repairs on your car. Or, on the other hand, if your car has been totaled in the wreck you will use this rental vehicle until the insurance company pays out a check for the totaled car and you can purchase a new one. You may also rent a vehicle during the time of setting up a claim and getting compensated. You will need to pay for the vehicle yourself (say if you don’t have a rental car option on your own insurance policy) and then be reimbursed for the costs later by the other driver’s insurance company. Having a rental car option on your own insurance policy is a good choice for these types of scenarios and usually tends to add very little to your monthly insurance costs. Watch the video now to learn more.